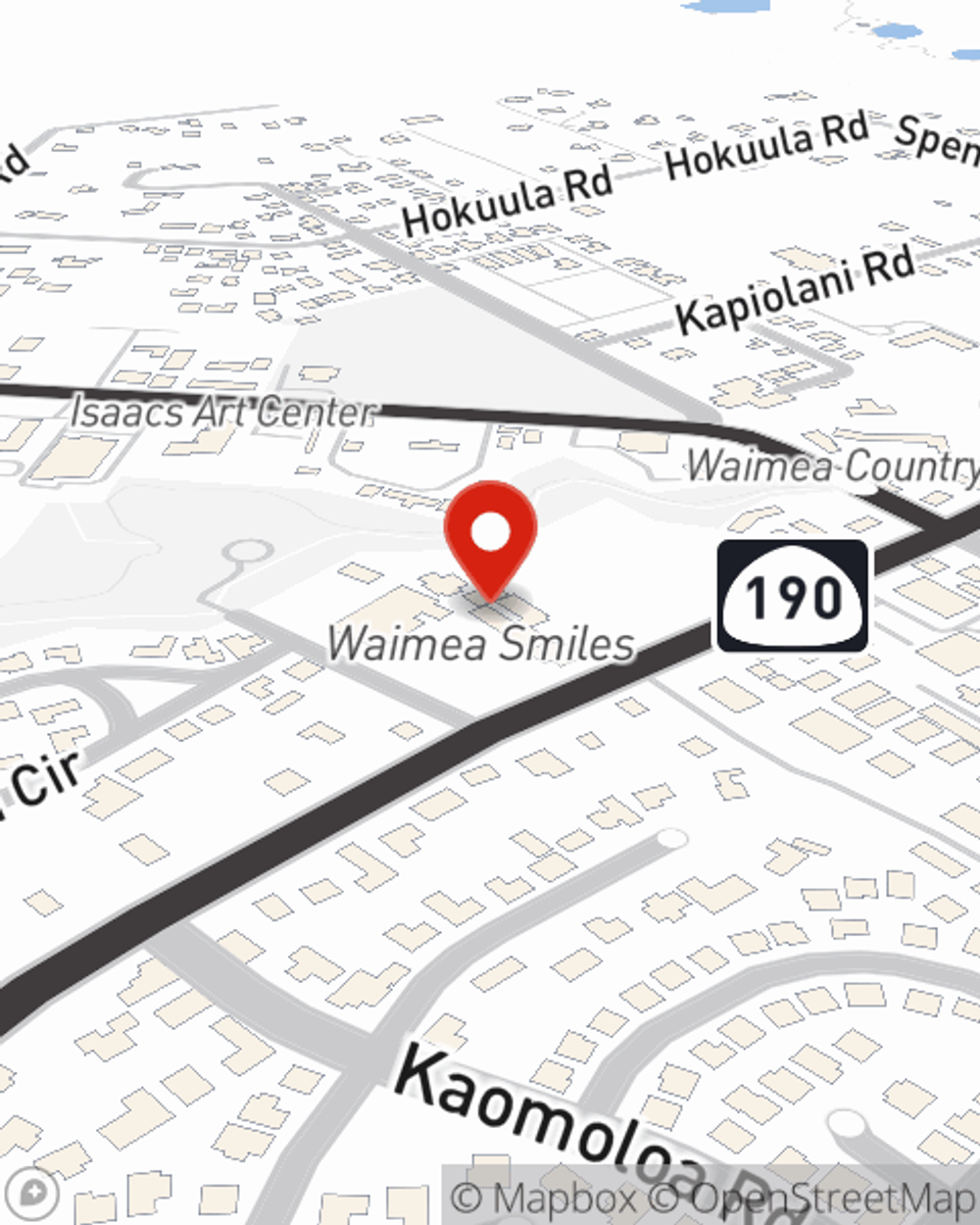

Condo Insurance in and around KAMUELA

Townhome owners of KAMUELA, State Farm has you covered.

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Things do happen.. Whether damage from weight of ice, smoke, or other causes, State Farm has dependable options to help you protect your condominium and personal property inside against unpredictable circumstances.

Townhome owners of KAMUELA, State Farm has you covered.

Quality coverage for your condo and belongings inside

Why Condo Owners In Kamuela Choose State Farm

You can kick back with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with terrific coverage that's right for you. State Farm agent Cheryl Kim can help you discover all the options, from a Personal Price Plan®, bundling to possible discounts.

As one of the leading providers of condo unitowners insurance, State Farm has you covered. Call or email agent Cheryl Kim today to get started.

Have More Questions About Condo Unitowners Insurance?

Call Cheryl at (808) 887-6170 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.